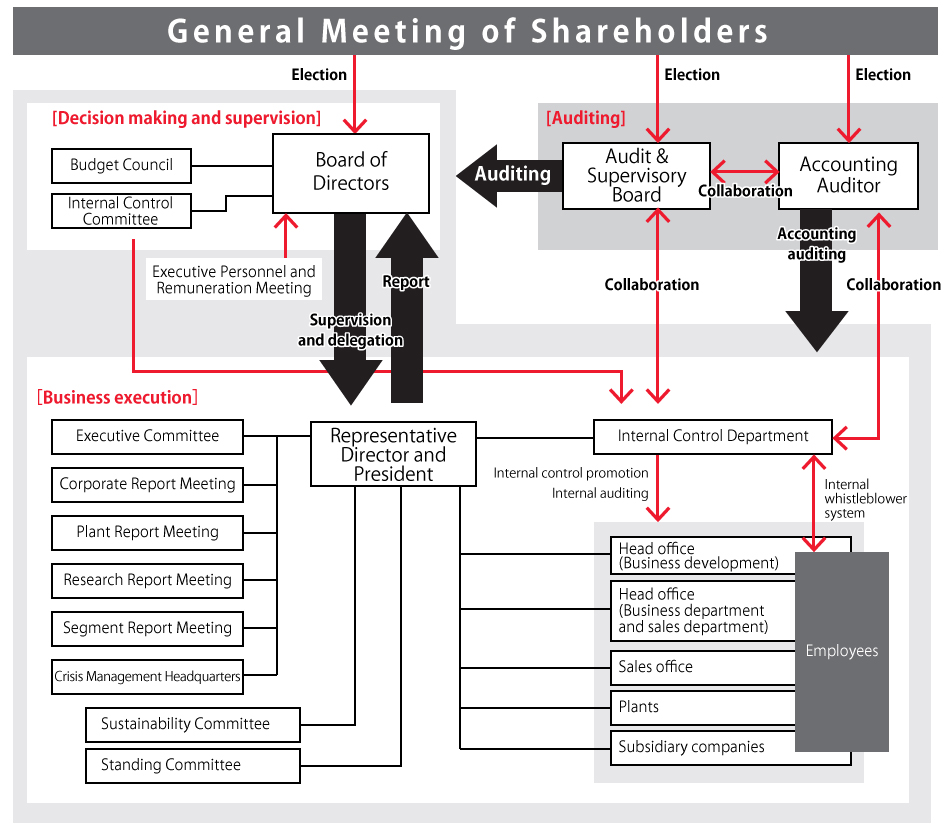

Governance

Basic Views

The Company is enhancing its corporate governance by seeking sustainable growth and striving to improve its corporate value over the medium/long-term through the establishment of systems that facilitate transparent, fair, rapid, and resolute decisions and the demonstration of entrepreneurial spirit based on the Management Philosophy, all without losing sight of its fiduciary responsibility as an entity entrusted by its shareholders with business management in addition to its responsibilities to them as well as its employees, customers, business partners, creditors, local communities, and other stakeholders.

System

Board of Directors

In Nippon Denko, the Board of Directors, which is composed of 11 Directors (including 6 Outside Directors), makes important decisions about overall business administration and supervises overall business execution.

So that the Board of Directors could make decisions appropriately from diverse viewpoints and strengthen the supervising function, 6 Outside Directors were appointed at the 125th Annual General Meeting of Shareholders held on March 27, 2025, and all of them were registered as independent officers at Tokyo Stock Exchange. We believe that corporate governance can be tightened by enhancing the supervising and overseeing functions of independent Outside Directors.

Main Topics of Discussion and Activities

- Revision of relevant rules and regulations accompanying the transition to a company with an Audit and Supervisory Committee

- Absorption-type merger agreement with Chuo Denki Kogyo Co., Ltd.

- Important matters for business execution Progress of sustainability initiatives

- Report on the execution status of each business

- IR and SR activity reports

Audit and Supervisory Committee

The Audit and Supervisory Committee monitors the economic activities of Directors and the status of governance from neutral and fair perspectives, to secure the sound growth of the Nippon Denko Group based on an appropriate corporate governance system. The Audit and Supervisory Committee is composed of 5 Directors, all of whom are Outside Directors. All of them were registered as independent officers at Tokyo Stock Exchange.

Main Topics of Discussion and Activities

- Formulation of audit policies and plans

- Status of execution of duties by directors

- Progress in the creation of medium/long-term corporate value

- Progress of sustainability initiatives

- Development and operation of internal control systems

- Appropriateness of business reports, etc.

- Appropriateness of audits by accounting auditor

- Evaluation and appointment of an accounting auditor

Skills matrix

| Name | Field | |||||||

|---|---|---|---|---|---|---|---|---|

| Corporate planning Business strategy |

Finance and accounting Financial and economics |

Personnel and labor Human resources development |

Governance and risk management Legal and compliance |

Production and technology Research and development |

Sales and purchasing Marketing |

Global | Environment Sustainability |

|

| Yasushi Aoki | в—Џ | в—Џ | в—Џ | в—Џ | в—Џ | |||

| Jiro Kobayashi | в—Џ | в—Џ | в—Џ | |||||

| Masakazu Tsumoda | в—Џ | в—Џ | в—Џ | |||||

| Tsutomu Kishikawa | в—Џ | в—Џ | в—Џ | |||||

| Yasuhide Miyake | в—Џ | в—Џ | в—Џ | |||||

| Kazutoshi Ohmi | в—Џ | в—Џ | в—Џ | |||||

| Kentaro Ono | в—Џ | в—Џ | в—Џ | в—Џ | ||||

| Kazunari Itami | в—Џ | в—Џ | в—Џ | в—Џ | ||||

| Hokuto Nakano | в—Џ | в—Џ | в—Џ | |||||

| Masahiro Tani | в—Џ | в—Џ | в—Џ | |||||

| Aogi Suemura | в—Џ | в—Џ | в—Џ | |||||

Evaluation of the Effectiveness of the Board of Directors

Analysis and evaluation process

- January All directors fill out questionnaires

- January to February Analysis based on collected results

- February Exchange of opinions and evaluation at the Board of Directors meeting

- August to December Formulation of future tasks

Through the above analysis and evaluation process, it was confirmed that all of the operation of the Board of Directors, resolutions, reports, and deliberation time were appropriate. With the transition to a company with an Audit and Supervisory Committee in March 2024, open and lively discussions based on diverse perspectives from both internal and external directors have deepened even further. Apart from the Board of Directors, we have established an executive roundtable forum for more in-depth discussions on issues.

Issues identified for the fiscal year ended December 2024

- Strengthening of the supervision of the business portfolio and the deepening of discussions thereof

- Strengthening of the supervision of sustainability and the deepening of discussions thereof

- Further sharing of IR and SR activities with the Board of Directors and promotion of initiatives

- Increase of opportunities for discussion on overall risks, etc.

![close[]](/en/shared/img/sp/closeBtn.png)